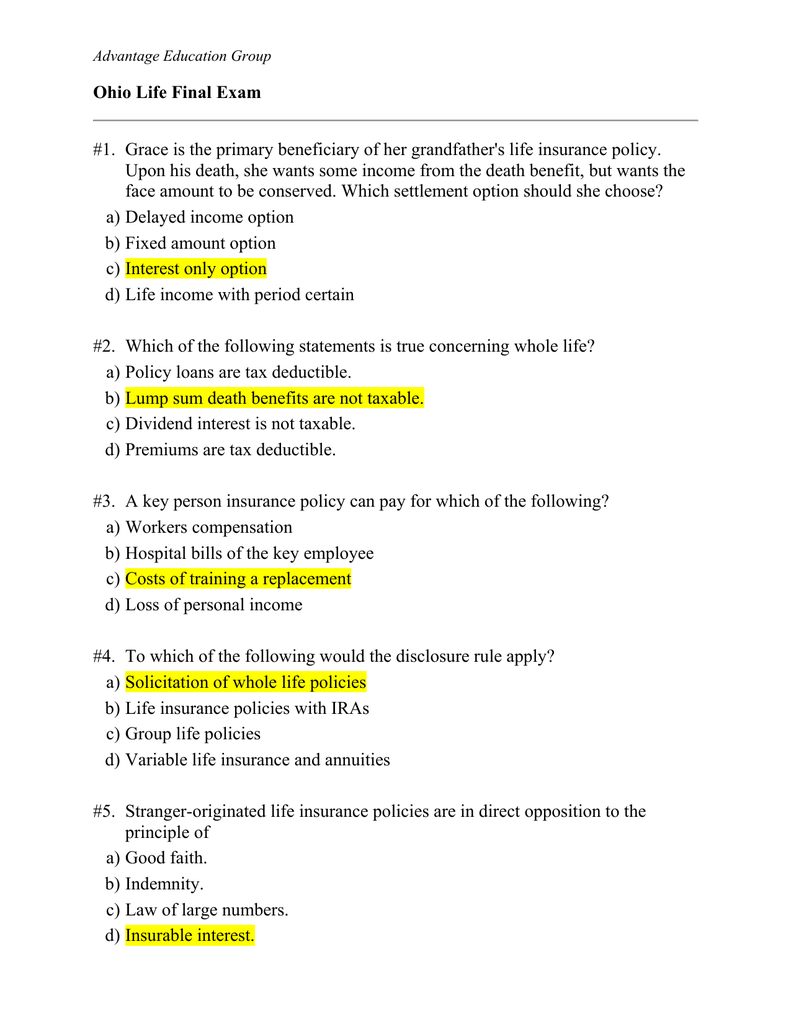

Which of the Following Accurately Describes a Participating Insurance Policy

Which of the following statements BEST describes what the Legal Actions provision of an Accident and Health policy requires. Notify the insurance company by telephone.

Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out on an annual basis over the life of the policy.

. Experts are tested by Chegg as specialists in their subject area. All of the following health care services are typically covered EXCEPT for a. A policyholder ownership B non-profit operations C taxable dividends to owners D assessable policies.

Which of the following accurately describes a participating insurance policy. If an insurance company issues a Disability Income policy that it cannot cancel or for which it cannot increase premiums the type of renewability that best desribes this policy is called. We review their content and use your feedback to keep the quality high.

Who are the experts. An insured must wait at least 60 days after Proof of Loss has been submitted before a lawsuit can be filed An insured must wait at least 60 days after Proof of Loss has been submitted before a lawsuit can be filed. Policyowners may be entitled to receive dividends 2.

While a policy may have participating status it is not guaranteed to necessarily receive dividends. A flexible premium deposit fund and a monthly renewable term insurance policy. Stock companies allow their policyowners to share in any company earnings d.

The employee is taxed on a percentage of benefits equal to the percentage of premium the employer pays. A Both parties to the contract are bound to the terms. Stock companies allow their policyowners to share in any company earnings 4.

Notify the insurance company in writing. G is an accountant who has 10 employees and is concerned about how the business with survive financially if he became disabled. Which of the following accurately describes a participating insurance policy.

Dividends come from the profits of the insurance company that sold the policy. The companys business model allows life insurance policyholders to benefit when the company has a profitable year. Experimental and investigative services d.

A comprehensive major medical health insurance policy contains an Eligible Expenses provision which identifies the types of health care services that are covered. Policyowners may be entitled to receive dividends b. Which describe a participating life insurance policy.

Policyowners pay assessments for company losses 3. Rules Governing Advertisement of Life Insurance and Annuities. An example of endodontic treatment is a.

That is the failure of one party to perform relieves the other party of his or her obligation. If the insured would like to cancel the policy heshe must. Which of the following BEST describes a short-term medical expense policy.

Students upto class 102 preparing for All Government Exams CBSE Board Exam ICSE Board Exam State Board Exam JEE MainsAdvance and NEET can ask questions from any subject and get quick answers by. Stock companies sell only non-participating policies B Mutual participating companies sell only non-participating policies. A mutual insurance company might be characterized by all of the following except.

Insurance contracts are conditional in nature. A modified endowment policy and an annual term insurance policy d. A flexible premium deposit fund and a monthly renewable term insurance policy.

Wait until the end of the calendar year. Hich of the following most accurately describes the tax treatment of group disability income benefits. A term insurance policy and a whole life policy c.

The difference between group insurance and blanket health policies is. A unique platform where students can interact with teachersexpertsstudents to get solutions to their queries. Policyowners are not entitled to vote for members of the board of directors.

An insurance contract is a contract of adhesion whereby the insurer prepares all contract details and the policy. A A mutual fund and an endowment policy b A term insurance policy and a whole life policy c A modified endowment policy and an annual term insurance policy d A flexible premium deposit fund and a monthly renewable term insurance policy. Policyowners are not entitled to vote for members of the board of directors.

A participating policy is an insurance contract that pays dividends to the policy holder. A participating life insurer is one that offers participating life insurance policies. Which statement most accurately describes a unilateral contract.

A mutual fund and an endowment policy b. Participating insurers may choose to pay dividends on all their whole life policies or provide the benefit for only select policies. Provide a reason for canceling.

In a participating policy the insurance company pays the policyowner a dividend out of which of the following. Which of the following combinations best describe a universal life insurance policy. Notify the insurance company in writing.

Blanket health policies do not issue certificates. Welcome to Sarthaks eConnect. A participating policy is insurance that pays dividends to policyholders.

All of the following statements about life insurance and the risk it covers are true. A participating life insurance policy is any policy eligible to earn dividends payable by the insurance company that issued the policy. Many financial resources confuse the definition of participating by claiming that it means the policy will.

In the latter case the companys lineup of. The purpose of this chapter is to set forth minimum standards and guidelines to assure a full and truthful disclosure to the public of all material and relevant information in the advertising of life insurance policies and annuity contracts. Policyowners pay assessments for company losses c.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Comments

Post a Comment